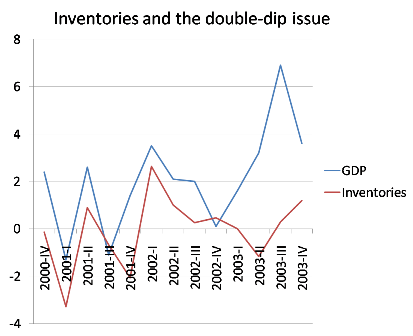

"There’s a tendency to treat worries about a double dip as outlandish, as something only crazy people like the people who, um, predicted the current crisis worry about. But there are some real reasons for concern. One is that the lift from fiscal stimulus will start to fade out in a couple of quarters. Another is that, as Yellen points out, most of the boost we’re getting now is tied to inventories. And that’s a one-time thing. You don’t have to look back very far to see just how transitory an inventory-led boost can be. The figure below shows growth before, during, and after the 2001 recession, together with the contribution of inventory changes to growth. Notice the boost from 2001IV to 2002I from inventories, then the fading out that almost, but not quite, turned into contraction later in 2002. It wasn’t literally a double-dip, W-shaped recession, but it came close.

Econbrowser more optimistically points towards Deutsche Bank's "credit impulse" indicator indicating a V-shape recovery. "Deleveraging implies slow growth in total credit, and according to the usual reasoning, slow growth in GDP. Several of Deutsche Bank's economists, however, focus on what they call the credit impulse. They provide the following provocative graph, which suggests a rapid recovery:"

No comments:

Post a Comment